A JOINT VENTURE PROPOSAL

in association with

in association with

Joint Venture Partner assigns (2) USA Patents with (26) Hydro-Scopic™ mining patent claims for 50% URSA common stock equity worth $100k with profit in gold royalties.

Sources and Uses of Funds:

A “Memorandum of Understanding” will be prepared on agreement to joint venture development of a prototype Hydro-Scopic™ mining unit. Total uses of funds for development are projected to be $3,550,000. Total uses of funds for Beta conversion and deployment (exploration) are $1,300,000.

The Investor and Geodrilling Technologies, Inc. will jointly form URSA Gold Corporation in Alaska as a regular “C” Corporation. A bank account will be established at “Wells Fargo Bank” (the dominant bank in Alaska) and upon legal review of note and corporate common stock issue, $3,550,000 will be placed in the corporate bank account. The total uses of these funds ($4,850,000) is outlined in the attached statement HERE.

Prototype Development, Validation, Testing – Year 1:

Total uses of funds – $3,550,000… See attached HERE.

Procurement – could require 6 months with the drill and high-powered pump – the most critical parts.

Testing – 3 months. [Please click HERE to go to the “Patents” button on the menu bar above] for a complete description of the “Patents” with testing procedures and objectives.

Trials – 3 months. Initial trials will take place at testing facilities in Grants Pass, Oregon HERE. A Plan of Operation for expanding into high-value target properties with transportation, setup and logistics analysis for efficiency is found HERE.

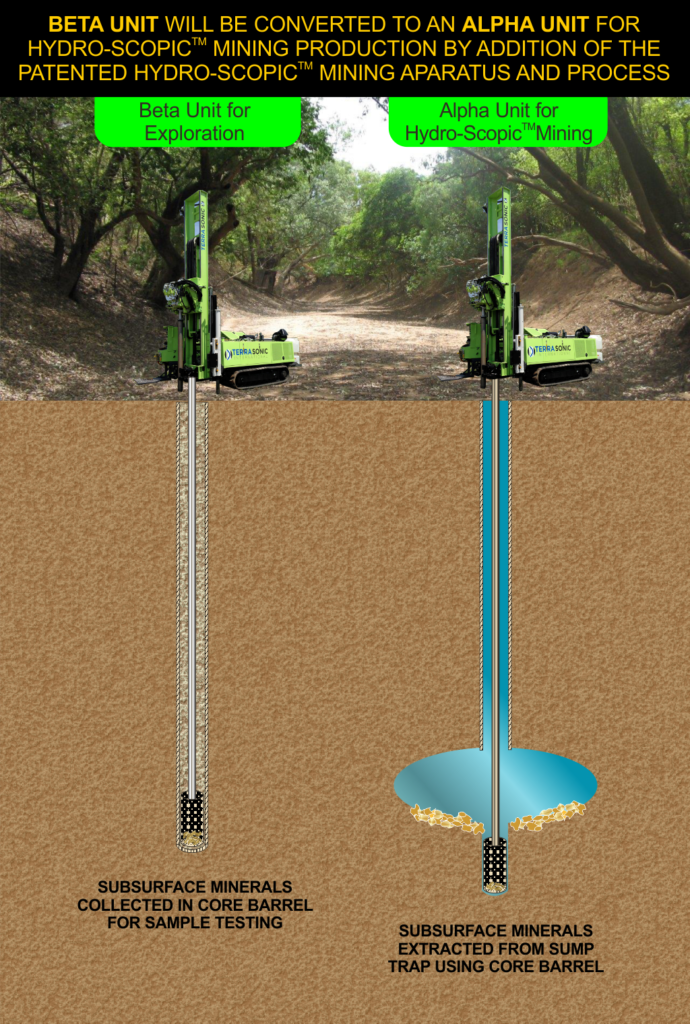

Year 1 will develop two prototype configurations: (1) Beta Unit – for exploration and measuring a resource; and, (2) Alpha Unit to mine that resource if it appears profitable. This is the same drill designed for quick conversion for Alpha mining a target site.

Failure unlikely… for reasons why. HERE.

Prototype Begins as a Beta Unit – Year 2:

Total uses of funds – $1,300,000… See attached HERE :

High-value target sites are the objective after proving the effectiveness of the Beta and Alpha Unit configurations of the prototype. These sites should yield at least 1,000 ounces per month with one crew mining 25 days a month on a 10 hour shift. Some high-value target properties have been identified with owner’s agreements for testing. A portion follows:

Mormon Basin, Vail Oregon; Private. HERE

Pine Creek, Cornucopia Oregon; Private. HERE

Similkameen Deposit, Oroville Washington; Claims. HERE

Valdez Creek, Fairbanks Alaska; Claims. HERE

Sherrette Creek, Nome Alaska; Private. HERE

Mud Creek, Candle Alaska; Claim. HERE

The Bluffs, Nome Alaska; Claim. HERE

Please note, these high-value target properties have various classifications that could sustain 1,000 ounces a month for two years. Mud Creek is a prime target having a minimum “measured” resource of 50,000 ounces of gold on 2,200 acres.

Annual Activity Flow

Beginning Year 2:

First six months – Beta Unit deployed for testing and “measuring” resource for high-value Alpha (Hydro-Scopic™ mining) production. Acquire target, begin production. Breakeven 8 ounces per day, minimum production 40 ounces per day to purchase another Beta Unit.

Second six months – Produce minimum 40 ounces per day. In six months unallocated gold should be 3,000 ounces. Purchase and upgrade new sonic drill for Beta Unit deployment. Balance for working capital and funding.

Year 3:

Monthly payment begins to purchase from URSA Gold Corporation the original “prototype” Alpha Unit now producing unallocated 500 ounces per month. Payment is 282.5 ounces per month leaving balance (217.5 ounces) used for new Beta exploration. This Beta Unit will be converted within three months to second Alpha Unit. Two more Beta Units are purchased with pending Alpha conversions when proving minimum measured reserves of 1,000 ounces per month.

End of year 3, monthly minimum production 4,000 ounces (4 Alpha conversions). Unallocated monthly ounces should be a minimum of 1,717.5.

Year 4:

This is the goal and considered the optimum year for accumulation of gold for shareholder distributions. Five Alpha Units should be in production by year-end, the Investor will have been paid off on the note and $5,000,000 will be retained for working capital. The accumulated balance of gold will then be distributed to shareholders.

This projection is based on a minimum measured resource producing ½ ounce per cubic yard. Just one Alpha Unit can produce the 5,000 ounces per month in a rich deposit showing a little more than 2 ounces per cubic yard. What if the deposit has a measured 10 ounces per cubic yard and all five Alpha Units averaged 10 ounces per cubic yard? Would you believe 100,000 ounces per month – $1,200,000,000 per year? Impossible? Not really! We know of places having these inferred deposits with more than 10 ounces per yard; however, they cannot be mined because of environmental concerns, too small to open pit, and primarily just too expensive to profit.

How expensive is Hydro-Scopic™ mining?

GeoDrilling Technologies, Inc. has teamed up with Boreal GeoSciences in Yukon, Canada to offer “cutting-edge” mining methods in the locating and surgical extraction of precious metals and other high value targets.

Resistivity Testing:

Why it is Important to Hydro-Scopic™ Mining

As one can see from absorbing the information on this website, the Hydro-Scopic™ mining method is very similar to Orthoscopic surgery where excavation is limited to a highly concentrated area that is most relevant.

In Hydro-Scopic™ mining the relevant area is an 8″ diameter borehole that will widen at the appropriate depth to mine the located placers. Relative to the topography of a typical drainage with placer potential, this is a small and precise excavation. Without prior knowledge of the geology at the targeted site a borehole may be unsuccessful.

However, in recent years Geoscientists have harnessed electronic methods to measure the conductivity, and subsequent resistivity of soils. And have learned to identify soil and aggregate types by the resistivity signatures common to various types of geology. These protocols are known as Induced Polarization and Gradiometric Magnetics.

What is so exciting about this technology is that it is non-intrusive, safe, quick, and done with minimal equipment and no excavation, other than minor trimming of inline vegetation. Thus, making the process cost effective over typical test drilling regimes.

In addition to the resistivity signatures of subsurface strata, ancient bedrock and paleo-channels can be located in a 3 dimensional model to within an acceptable tolerance factor for most mining operations. It is this accuracy in testing subterranean gravels that makes the Hydro-Scopic™ mining process so effective and profitable. Knowing were to drill is critical to Hydro-Scopic™ Mining. And resistivity testing is the technology that builds the maps for profitable placer mining.

President Trump’s Executive Order 13817

In light of the President’s current tariff strategy to curtail China’s abuse of intellectual property and other economic issues, it seems the United States has an Achilles’ heel – critical minerals. The US is dependent on foreign suppliers of many mineral resources for green energy, high-tech devises, and military superiority. China is the major supplier of these resources to the U.S. causing much concern.

Although gold is addressed herein as the primary target resource for Hydro-Scopic™ mining, gold is also considered a “critical metal pathfinder”. As such, exploring and sampling for gold will also identify these critical minerals that could be immediately mined if needed for national security reasons. In all cases sampling will be cataloged with exact location; and, when Alpha mined will accumulate concentrated heavy sands for future mineral requirements and analysis.

Hydro-Scopic™ mining is technology that could help, in part, to fulfill the President’s strategic goal of enhancing access, discovery, and production of critical minerals. Hydro-Scopic™ mining is green technology, very fast, and is currently the only mining process, pending prototype development, that can be implemented to explore and mine critical strategic minerals with many small operations at many locations – a tactical advantage.

Is China interested in Hydro-Scopic™ mining?

A Chinese mining company “Birnith” has already published the US Hydro-Scopic™ mining patent application on the internet. After notifying the US Department of Interior, it was removed.

Joint Venture partner invests $4,850,000 for a $6,000,000 “Original Issue Discount” (OID) note and $100,000 in voting common stock in exchange for a 50% non-dilutive equity share in URSA Gold Corporation.

Note Terms:

$6,000,000 OID note is given for $4,750,000 in cash funding for prototype validation, trials and production for two years without payment. This is 12.0% Annual Percentage Rate (APR) for two years. Amortization of this $6,000,000 OID note begins in two years with monthly payments (in gold if preferred) of $282,500. Amortization includes interest at 12.02% APR. Interest for four years is $2,030,000 (more than 12% APR).

Note Security:

Geodrilling Technologies, Inc. is assigning to URSA Gold Corporation the “Patents” for the Hydro-Scopic™ mining process in exchange for 50% equity worth $100,000 in voting common stock of URSA Gold Corporation. Geodrilling Technologies’ common stock will be security for the note.

Investor’s Prototype Equity

URSA Gold Corporation –The “Patent” and “Prototype Drill Rig” Developer (to be formed when funding).

The Investor and Geodrilling Technologies, Inc. are joint venture shareholders. Geodrilling Technologies, Inc. is an Oregon regular “C” Corporation with Tom Hice the sole shareholder. URSA Gold’s primary objective is to fund and manage development, validation and testing of the Hydro-Scopic™ mining prototype for deep recovery of valuable minerals with environmental sensitivity. Secondly, it will put the drill into production on high-value property (minimum 1,000 ounces of gold per month).

Income will be a pervasive 5.0% royalty on all Hydro-Scopic™ mining production. It will be retained in the Corporation for feasibility studies and development including, but not limited to, profit centers such as:

Within two years the prototype will be used as a Beta Unit (exploration) to locate high-value target properties and then converted to an Alpha Unit (production) to recover at least 1,000 ounces of gold per month. At that time, the mining Corporation (Ursa Minor Corporation – to be formed) will purchase the prototype from URSA Gold Corporation for $285,000 per month for 24 months. The $6,000,000 note will be paid off with this payment at 12% APR.

Investor’s Other Equity

Hydro-Scopic™ Properties, LLC – a mineral rights holding Company (to be formed).

The Investor will have a 50% equity ownership in this Company. The other 50% will be owned by individual shareholders of HERC Gold Corporation – the mining franchise entity (less than 30 shareholders).

The Company will hold and legalize all mineral rights subject to Hydro-Scopic™ mining. Variable royalties based on Beta Unit testing will be negotiated subject to actual production. Distributions will be paid to corporate shareholders as members in this Company which will avoid double taxation at the corporate level.

Ursa Minor Corporation – High-value property Hydro-Scopic™ Mining Corporation (to be formed as an Alaska regular “C” Corporation – a privately held Corporation).

The investor will have a 50% equity ownership in this Company. Shareholders in Herc Gold Corporation will have the other 50% ownership in equity.

High-value property will regularly produce more than 1,000 ounces of gold per month with 500 ounces available for more Beta purchases with subsequent Alpha conversions. One Alpha Unit (the prototype) will produce 500 ounces per month that is available for distribution after paying off the $6,000,000 note and purchasing a Beta Unit that is available for distribution. After year 4, just the prototype as an Alpha Unit, can distribute a minimum of 3,000 ounces per year to the Investor having a 50% equity share.

Herc Gold Corporation – Successor to Hice Exploration and Royalty Corporation (Founders, Friends and Family Shareholders). A regular “C” Alaska Corporation.

Will proceed after prototype verification and proof of production to market low-value property (less than 1,000 ounces per month). Will establish a regulated franchise model with equipment funded by an IPO. See www.hercgold.com for franchise gold mining.

Conclusion for Investor – after $6,780,000 Payback on Investment within Four Years – a 12.0+ APR:

If only the prototype is used for locating high-value ground with a measured resource of at least 1/2 ounce per cubic yard, the annual yield to the Investor is 3,600 ounces (includes royalties to URSA Gold and Hydro-Scopic™ Mining Properties). Four other Alpha Units doing the same would annually yield to the Investor 18,000 ounces.

What if the measured resource is 5 ounces per cubic yard? This would be the same as having ten Alpha Units mining minimum ground with costs for one unit. This would annually yield 36,000 ounces to the Investor from just the prototype.

It should be apparent that the real value here is in the real estate mineral properties (Hydro-Scopic™ Properties, LLC). All it takes is just one property like Valdez Creek or Sherrette Creek producing a couple of ounces per yard at 100 feet to get rich. Even property showing less than ½ ounce per yard might be profitable if franchise mining. If you look for this kind of property for sale with subterranean wealth in gold, you will not find it. It is worth nothing! No one can mine it!

How much is it worth with just one prototype?